CARES Act - Don’t react too quickly

We’ve seen the news that Congress passed the CARES Act and we all know there are some good provisions included for non-profit organizations. But what might not be immediately clear is – what we should DO with this information.

What do you do about the members when the museum is closed?

There is no question that all of us who work with museums and other cultural institutions with membership bases are in unchartered waters with the coronavirus and the economic uncertainty it is causing. Organizations are juggling countless priorities to make sure their staffs and volunteers are safe while struggling to make decisions around business continuity. What do you do about membership renewals when your museum, zoo, science center or theater is closed for an unknowable amount of time?

Animal Welfare Fundraising During Coronavirus and Economic Uncertainty

There is no question that all of us who raise funds for animal welfare organizations are in unchartered waters with the coronavirus and the economic uncertainty it is causing. Organizations are juggling countless priorities to make sure their staffs and volunteers are safe and that the animals continue to receive optimal care. And, they are struggling to make decisions around business continuity, including fundraising plans. Events are being cancelled or postponed resulting in a significant loss of revenue.

Fundraising During Coronavirus and Economic Uncertainty

There is no question that we, who work in the non-profit world, are in unchartered waters with the coronavirus and the economic uncertainty it is causing. We’ve heard over and over from clients that they are struggling to make decisions because the situation is changing minute by minute.

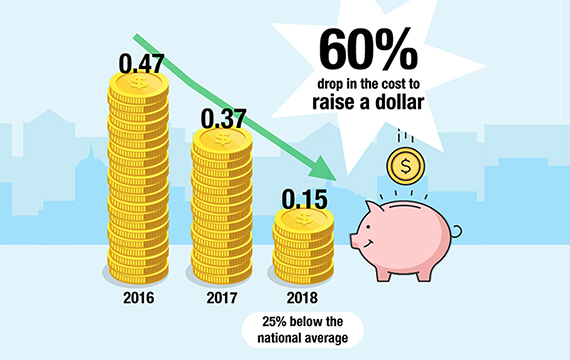

It’s not how much you raise. It’s how much you keep.

When meeting with non-profit clients for the first time, I am often surprised by how many development officers are still talking about how much money they raised with their last fundraising appeal or event.

Steps Toward Building Emotional Connections with Your Audiences and Increasing Revenue

A fully engaged customer or donor who feels emotionally connected to your organization is key to increased revenue. You need to know who your audience is and what will motivate them to engage. The insights for building those emotional connections that drive loyalty and advocacy for your organization or brand may be hidden in your database, or you could need research. How do you know?

Designing Research to be Actionable

In our previous article, “You have to know your donors to engage them,” we outlined the data points needed to build the emotional connections with your donors that lead to increased ROI for your fundraising. Many of those points can be found in your existing donor data, or through data appends, but some points will require primary research. In this article, we outline how to design research to be useful in creating more relevant and meaningful communications.

You Need to Know Your Donors to Engage Them

Most fundraisers are familiar with the idea that it’s less expensive to keep a donor than to find a new one. And many are aware about how to retain donors: they need to build strong connections between the charity and the donor. In the past, charities have focused on the importance of making rational, deliberate appeals on the assumption that donors made rational, deliberate decisions when giving.

Do You Really Need to Worry about Building Emotional Connections with Your Target Audience?

There’s a lot of conversation around behavior science and how emotion influences the decision to buy, donate or join in the marketing blogosphere these days. Many of those conversations cite the work of Nobel Prize winner and psychologist, Daniel Kahneman. In his 2011 book, “Thinking, Fast and Slow,” Kahneman argues that the mind incorporates two systems for decision-making: one that works quickly making decisions more on intuition and emotion, and a second that works more slowly to rationalize the decision. Because it takes less effort, we’re more likely to rely on the first system.

Is a 1200% Increase in Net Proceeds over Five Years Possible? You Bet.

CHALLENGE:

A 1,200% increase in net proceeds may not seem possible, but that’s exactly what we helped the Detroit Zoo achieve over a five-year period through a more efficient and targeted marketing program.

End of Year Appeal Season is Over. And the Results are In!

The results of appeal season are in for Children’s Leukemia Foundation of Michigan (CLFM) and the impact of a new approach has been dramatic.

40X Better than Average: PI's Low Spoilage Rate Illustrates Stellar Processes

Phoenix Innovate is pleased to announce our 2018 spoilage rate of .1%. According to the latest survey from Printing Industries of America (PIA), the industry average is 4%.