Tax Legislation and Its Historical Effect on Charitable Giving

Every announcement by a new administration about plans to reform the tax law is met with a certain amount of trepidation by charitable organizations of all sizes. But, the reality is that most individual donors don’t give for the tax break. A tax break is a welcome benefit, but most donors give because they believe in the cause, want to help or were asked by someone they know to donate.

So, what effect should the Tax Cuts and Jobs Act have on charitable giving? There are some who are concerned that a reduction in the number of people who itemize deductions on their tax returns could mean a reduction in giving.

Conversely, it stands to reason that if disposable income increases because of new tax laws, and the capacity-to-give increases, then charitable donations will go up.

Here at Phoenix Innovate we promote the idea of insights driven decision-making, so we look to historical evidence to guide our thinking.

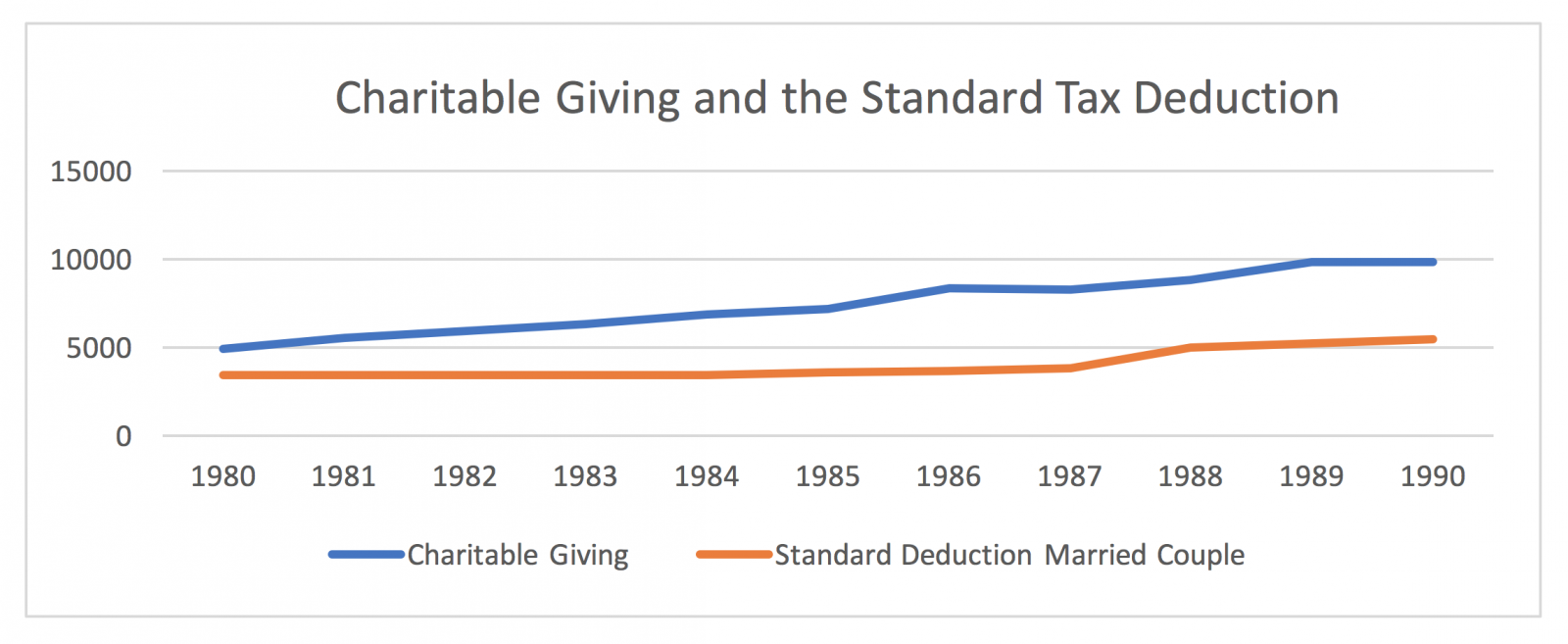

In 1986, when President Reagan’s tax plan was passed, donations surged as donors sought to double-up and take advantage of deductions before they disappeared under the new plan. In 1987 charitable giving took a dip vs. the surge in 1986, but it was still in line with the growth in charitable giving experienced for the 5 years prior.

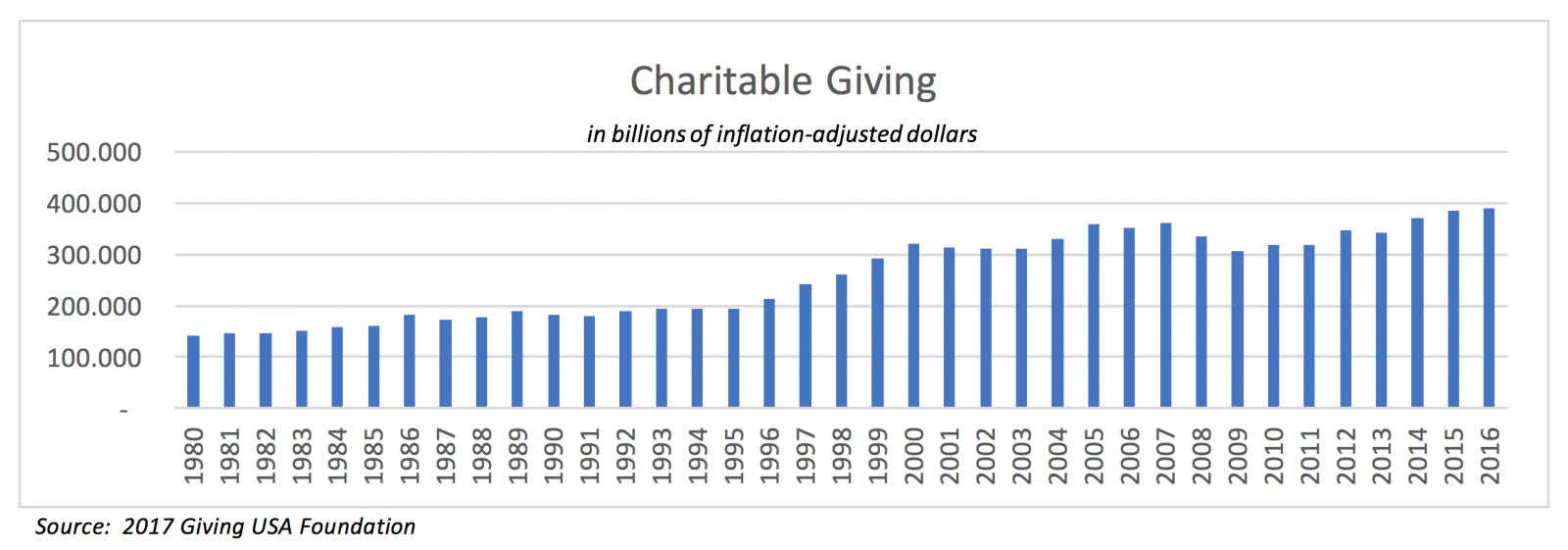

Charitable Giving Source: 2017 Giving USA Foundation

Standard Deduction Source: IRS.gov

*Before tax year 1987, the standard deduction was known as the "zero bracket amount", and had a slightly different impact on taxpayers' tax liability. The Tax Reform Act of 1986 instituted the standard deduction as we know it today. Nevertheless, for the sake of comparison, pre-1987 zero bracket amounts are included side-by-side with standard deduction amounts.

The 2018 Tax Cuts and Jobs Act is different from Reagan era tax legislation in that the increase in the standard deduction is so big, it will almost certainly result in fewer people itemizing deductions. Whether this change will impact giving is yet to be seen, but there’s no historical evidence that charities should be concerned.

In fact, a look at charitable giving over time indicates that regardless of the tax legislation in place, charitable contributions have continued on an upward trajectory with only minor dips related to overall economic conditions for the past 37 years.

Nonetheless, to safeguard against lower levels of giving, whether due to changes in the tax plan or the economy, it is always important for a charity to clearly communicate its mission, build connections with its donors and be smart about who it targets with appeals.

Phoenix Innovate has been working with charitable organizations to establish measurable goals, and developing the action plans to achieve those goals for over 30 years. Want to know more? Contact Kirk at 248-519-0450.